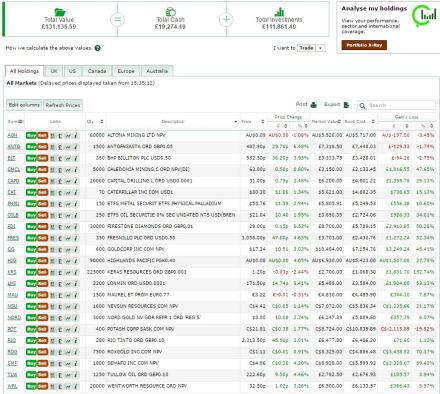

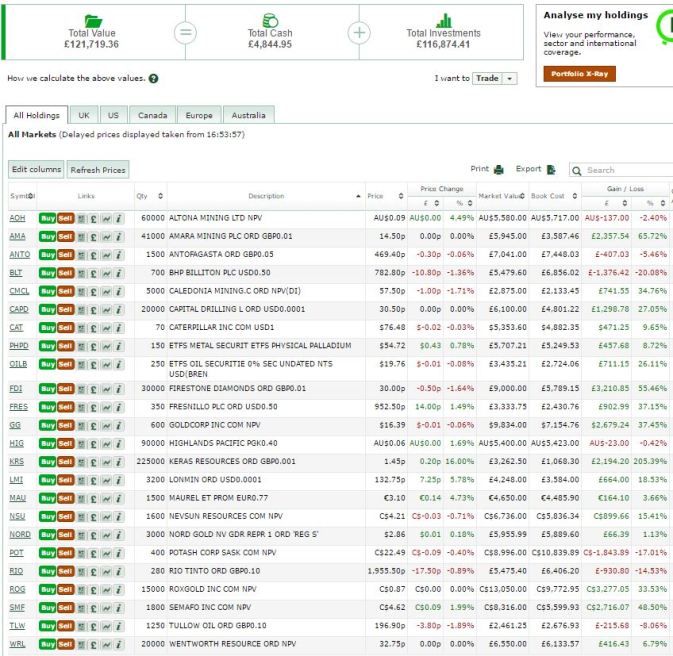

Took advantage of a second day of market weakness yesterday to put some of Contrarian’s cash to work, buying:

- A further 70 Caterpillar (New York: CAT) at $75.33;

- An additional 75 PHPD at $57.22 (this is a physical palladium ETF – i.e. it holds the actual metal as the backing for each share so should track the palladium price very closely apart from a small mgt fee) – I already had a fairly substantial holding but I really like palladium;

- 4000 Ophir Energy (London: OPHR).

So why Ophir?

The shares fell 28% in three days after the company announced that the Schlumberger deal to fund their major Fortuna FLNG project had fallen through. Whilst we are scanty on details, it would appear to be commercial rather than technical considerations which scuppered the deal. This puts back the timing of that project, possibly significantly, and there is no certainty a new deal can be found on similar commercial terms.

But…

- The Fortuna project itself still looks robust (albeit at slightly higher gas prices), and the $450-500m capex estimate is relatively bite sized (for LNG where capex usually runs into the billions)

- The company has a market cap of $684m and, unusually for a producing oil and gas company a significant net cash position ($355m) giving an EV of just $329m.

- In addition to the (albeit now unfunded) FLNG project, Ophir has low cost ($15/bbl) producing assets in SE Asia with 55MMbo of 2P reserves and Indonesian gas to come on stream in H216. And loads of exploration acreage.

This may be a slow burn, but I believe the upside is 3-4x the current share price.

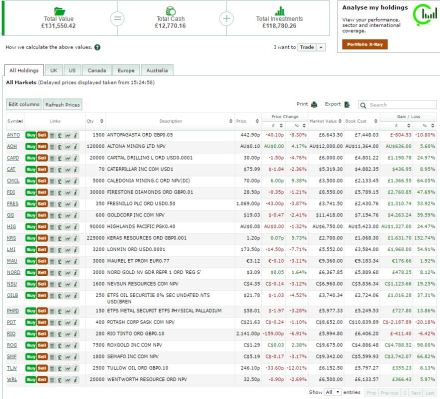

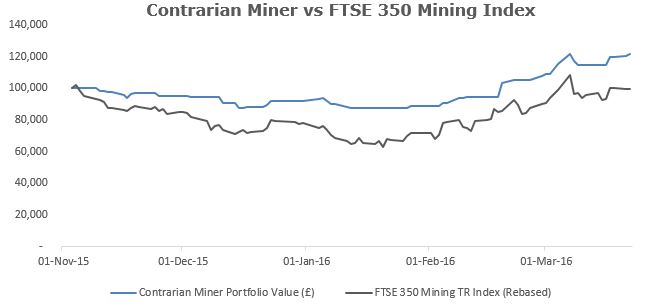

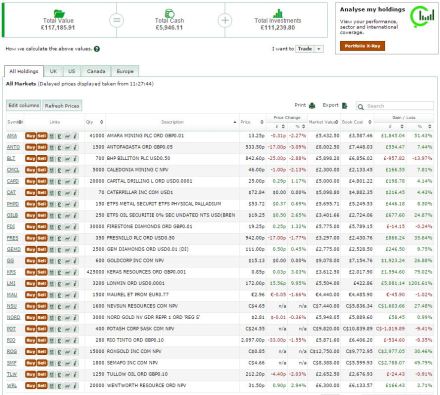

Pretty flat today, Contrarian stands at £129,615, and I now have just £3,421 in cash.