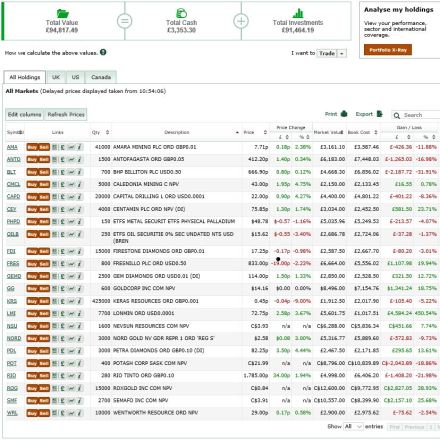

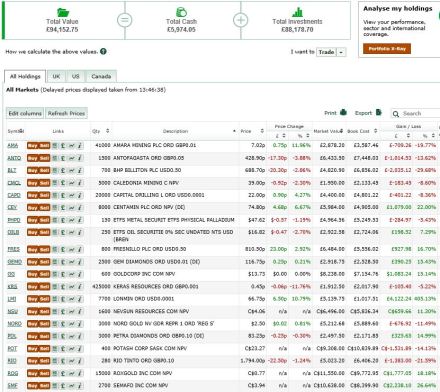

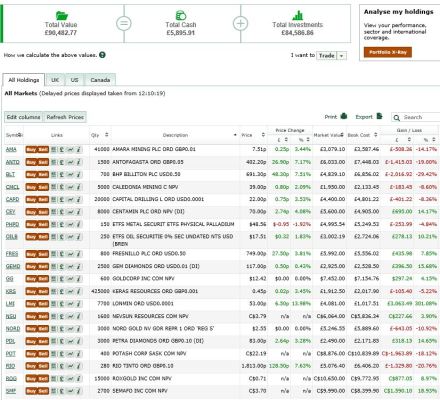

I’ve today sold 2,500 LMI at 91p realising a loss of 18% on these shares (my average in was 112p with the bulk of my holding bought in the rights issue at 100p), but retaining 5,200 shares for the longer term.

I initially intended to invest c£5,000 in Lonmin , but when the nil paid rights were trading near zero I bought more and subscribed for the shares in the hope of a short term bounce once the rights issue was behind the company. Far from materialising, the shares continued to plummet to a low of under 40p and I found myself in a “short term trade gone wrong becomes long term investment” scenario.

In my view, the long term outlook for platinum is >30% above current levels and that means Lonmin offers very significant long term value. However, (despite the recent bounce in the platinum price) at spot rand basket prices Lonmin is still cash flow negative by around US$100m a year and that is clearly not sustainable even if the recapitalisation has removed the immediate funding pressure.

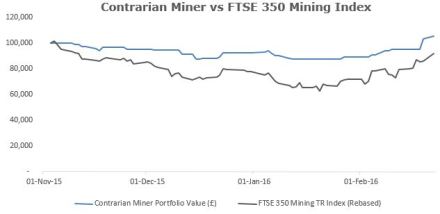

And so,while I am happy to remain an investor in Lonmin, I was uncomfortable with it being my biggest single investment. Following the recent sharp rise in the shares, it seemed sensible to take the opportunity to reduce my holding from c7% to <5% of the portfolio – a level at which I feel more comfortable to weather any short term volatility.

Over the next week I will be looking to do a bit more “rebalancing” of the portfolio – reducing my gold exposure and topping up some of my smaller holdings but I am also on the lookout for one or two new things to add. Ideas welcome, particularly smallcap or non-UK.