In my last Contrarian Miner post at the end of November, I said I would be selling down the portfolio over the next 6 weeks. For various reasons involving the complexities of Delaware LLC’s and offshore feeders that I will not bore you with, it’s taking a touch longer than that. But the process has begun and I thought in the interests of completeness I would officially bid you all farewell with a last look at Contrarian Miner.

It’s been quite a challenging final period for Contrarian Miner. Until very recently, the precious metals and particularly 15% platinum exposure has looked a bit premature as has the 12% exposure to junior nickel companies. Relative to a FTSE 350 benchmark which is comprised 86% of Rio Tinto, BHP Billiton, Anglo American and Glencore, the result has been that the index has almost caught up with me from behind. See chart below.

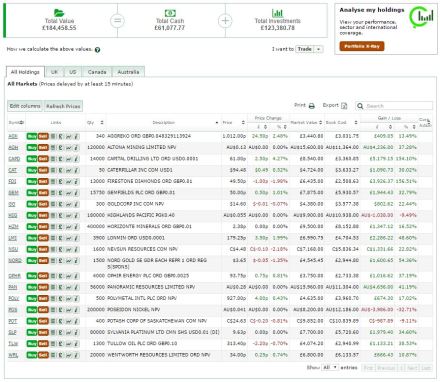

However in absolute terms the portfolio is ending on a high note, and one of which I am very proud. The Contrarian Portfolio stands at £184,459 – up 84.5% since I started in November 2015. I currently have £61,077 in cash (mostly dollars)- roughly a third of the portfolio – which seems a sensible point to call an end to tracking the performance of the Contrarian portfolio performance (and by extension my very short blogging career).

Farewell followers. Final portfolio snapshot below…