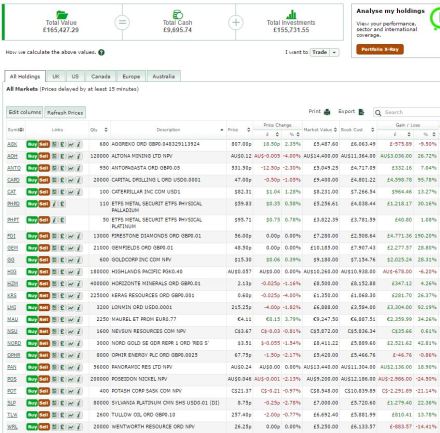

I can hardly believe it’s been a year since I started Contrarian Miner. But it has – on 5th November 2015 I had £100,000 in cash waiting to be spent. A year later the value has grown to £165,427 – well on my way to achieving my stated objective of doubling my money within 2 years.

Hitting the one year mark, I thought I would take a moment to reflect on the performance of the portfolio and some of the good/bad decisions I have made along the way.

The portfolio is up 65% over the past year, against the FTSE 350 Mining (Total Return) Index up 48% over the same time period, so I am very pleased. Nevertheless, I can’t help feeling a little disappointed with the portfolio’s more recent performance as it has lagged on a relative basis in recent months. See chart below.

Of the £65,427 gain:

- £25,460 is unrealised capital gains:

- Includes significant unrealised gains on Capital Drilling (£4,600), Firestone Diamonds (£4,771), Lonmin (£3,304) and Gemfields (£2,278)

- c£38,460 is realised capital gains

- Of which 50% was from 6 stocks – Roxgold £5,025, Fresnillo £4,450, Semafo £4,320, Firestone Diamonds £4,795 – in addition to the unrealised gain above, Amara Mining £2,960 (I sold on the bid) and Centamin Egypt £1,981

- Don’t even ask about Capital Gains Tax

- c£1,500 is from dividends – a modest 1.5% dividend yield on the portfolio this year

Looking back what would I have done differently if I started all over again?

The funny thing is that I already knew my investment weakness – buying too early and selling too early. And despite knowing that and trying to sit on my hands, I sold almost everything I realised profits on way too early and put the money into other stocks which I still have great confidence in, but most of which have yet to move. Meanwhile my top performing stocks continued their strong runs.

Had I invested in the same starting portfolio last November but then done nothing for the rest of the year I suspect I would have been up far more – I haven’t actually mathematically back tested this so I am extrapolating from a selection of stocks I have looked at, but I’m pretty sure I’m right. Probably better not to actually test that – it suggests I have wasted a great deal of time between last December and today. So my new year’s resolutions are to:

- Trade less,

- Don’t underestimate how far stocks can move – just because something is up 100% does not mean it does not have a lot further to run,

- Before rotating from top to bottom performing sub-sectors (e.g. from gold to nickel) wait, and then wait some more, and then wait some more. Let momentum work for me, just a tiny little bit (don’t worry I am still a Contrarian).

Portfolio below (at Friday’s closing prices).