Shareholders in Panoramic Resources (ASX: PAN) have been offered priority in the upcoming Horizon Gold IPO (the spinout of the Gum Creek gold project from PAN). I bought PAN for the nickel assets, ascribing no value to either the gold or PGMs. But ever one for a bargain, I’ve been doing some homework on Gum Creek but decided against.

Horizon will have a post IPO market cap (at the A$0.40/share offer price) of A$30.6m of which A$13.65m will be the new cash leaving an A$16.9m EV. With a gold resource of A$1.25Moz that is an EV of just A$14/oz- arguably a bargain, right? But:

- The development studies will build on the March 2016 scoping study for free milling gold. That estimated AISC as A$1,209/oz (US$931/oz at current exchange rates but lets not forget the A$ was a parity not that long ago),

- The scoping study saw production of just 290koz over a 6 yr life (i.e. even assuming a gold price of A$1,700/oz, not that much of the 1.25Moz “resource” is economic)

- Even at a gold price of A$1,700/oz the mine generated EBITDA of just A$29m a year and thus takes more than 2 yrs of its 6yr life to pay back its A$62m capex

- They will be spending the A$13.5m raised in the IPO over the next 2 years on exploration and development studies – this is quite a “slow burn” opportunity

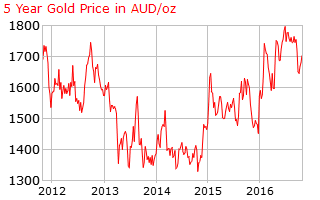

And here is what the gold price in A$ looks like over the last 5 years. A$1,700/oz is close to 5yr highs. Sure the USD gold price may move higher, but currency may move in the opposite direction. For me this is not a value opportunity. Now perhaps there is lots of exploration potential and room to optimise. But I don’t see clear value so Horizon Gold is not for me.

As a PAN shareholder I am, however hoping other feel differently and it flies. They keep 51% of Horizon so at the IPO price that is worth A$15m. PAN also has A$19m in cash leaving an EV for the nickel assets (and PGMs) of just A$66m.