Tricky business finding contrarian buying opportunities in the mining sector currently.

Possibly some of the gold stocks might be worth a look.That said the chart below suggests otherwise at least in the London market. It maps the gold price against the share prices of Randgold, Acacia and Centamin. The gold price today is US$1,254/oz. On 21 October 2014 it was US$1,251/oz i.e. its flat. But Centamin is up 105%, Acacia is up 60% and Randgold is up 40% over the same period. Hmmm.

So instead I bought PHPT (ETFS Physical Platinum ETF) – 50 shares at $92.30. The platinum price has fallen by 19% in the past two months as wage negotiations in South Africa appear to be reaching an amicable conclusion and so the threat of strikes recedes. But the market is nevertheless in deficit (by c7% of world demand) and has been for a years. Yes, rock bottom prices in a deficit market. Odd but true. Plenty of stocks means that the market doesn’t feel like its short of the metal and the ETFS have been net sellers rather than buyers (they tend to be momentum buyers on the up and sellers on the way down, exacerbating the moves)

Could the platinum price go lower – sure, it’s been down to $818/oz in the past year and very briefly traded just below US$800/oz at the height of the financial crisis. But even assuming it did revisit those levels that’s only 17% downside. On the other hand in 2008 it hit US$2,196/oz in in 2011 it touched US$1,855/oz – 93% above current levels. And to me that is an asymmetrical risk opportunity. I’d like more, but with the broader mining sector so overbought I feel like I’m quite happy having £7,408 in cash so it might have to wait until I find something to sell. I also own Lonmin, Sylvania and a palladium ETF as well, so on a portfolio level I am pretty long PGMS already.

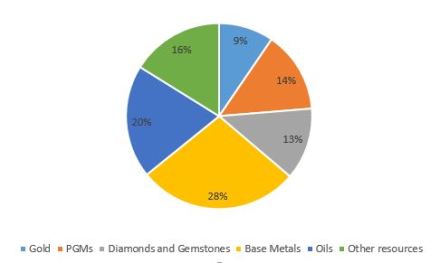

Hang on, here’s a chart of my commodity exposure for you….14% PGMS, only 9% gold (hmmm – may need to go shopping), 13% diamonds and gemstones, 28% base metals (and very happy with that), 20% oils, 16% mining equipment and services

Contrarian stands at £168,667 today, close to its all time high. Full portfolio below.