Having spent weeks trying to persuade myself not to sell my Caledonia shares too soon (a mistake I always seem to make) last Friday I gave up the fight and sold my remaining 2,500 shares at 123p – a profit of 193% on my 42p investment last November. Of course the shares are up another 7% since then to 132.5p today.

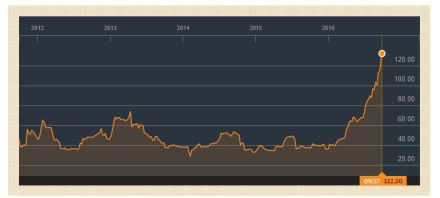

Still I wouldn’t be much of a contrarian if the chart below inspired me to do anything other than sell. Moving up in a pretty straight line on very little news and not much change in the gold price. Arguably there is still value in the shares. But a small underground gold mine in Zimbabwe – I’m happy to leave the last bit to someone else.

The value of Contrarian stands at £166,314 up 5% since I last posted on 9th September. Portfolio performance has been helped by strong showings from Gemfields (+29% following good results yesterday with strong growth plans); Firestone Diamonds (+17% as the company moves towards first production within the next few weeks), and ASX-Listed Panoramic Resources (+29% on no particular news). But with energy stocks hampering performance (Ophir -6%, Tullow -6%, Wentworth – 7%), that still leaves me slightly underperforming the FTSE 350 Mining Index (Total Return) which is up 7% since last post.

Still, with Contrarian at an all time high, I return to the debate as to whether it is relative or absolute performance that matters to the private investor. Chart below.