Early last week I was scratching my head for mining stocks in my portfolio to sell, and amidst the turbulence of the sector (down almost 3% today) the head-scratching has continued.

Now some may say today doesn’t look like a good selling day for a Contrarian. But in the context of the price movement this year, today’s sector move is small beer. What I worry about is that broader market weakness could trigger a far more significant correction in a sector that has moved very rapidly.

So continuing with the theme of selling stocks most likely to move with the index (rather than smallcaps with low liquidity and potential company-specific surprises), but this time trying to avoid stocks which have already fallen sharply, I sold today:

- 55 PHPD – a palladium ETF which holds the physical metal. At $706/oz the palladium price is up 40% since I bought the ETF, and down just 3% from its 6 month peak;

- 40 Caterpillar (New York: CAT) – up just 15% since I bought it but down only 1% from last week’s 6-month high. I might be tempted to buy these back lower down (but not within 30 days or HMRC will bite me).

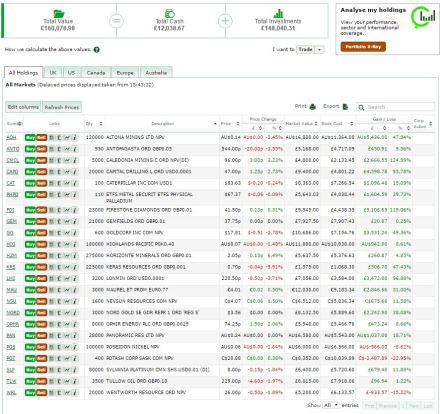

Following the sales, Contrarian Miner has £12,039 in cash. A nice warchest.

The value of the Contrarian Portfolio stands £160,079 down less than 1% since I last posted which I am very pleased with.