Today I found myself faced with a dilemma – I feel like the mining sector (up 43% since the beginning of June) is overdue a short term pullback but looking through the Contrarian portfolio I struggled to find anything to sell.

Usually I find myself selling whatever is up strongly and particularly where I’ve made >100%. But at the top of my leader-board are Caledonia Mining (+125%), Lonmin (+115%) and Firestone Diamonds (+107%) – all shares I still like, with plenty of potential upside.

There are perhaps a few shares in the portfolio I have doubts about. Keras Resources and Nevsun spring to mind as stocks where I am not sure I am aligned with the choices management have made since I invested. For Nordgold the value gap relative to peers has increased rather than narrowed since I bought and I’m now wondering whether it will ever close the gap given the lack of free float and with the proposed move to an LSE full list seemingly on the back burner. But none of these strike me as particularly good reasons to sell – all of these stocks have significant upside potential and none look toppy.

So instead I have picked on the large caps in the portfolio that should most closely follow the performance of the mining sector – reducing my holding in Antofagasta (selling 550 shares at 558p) and selling the remainder of my shares in Rio Tinto (130 at 2512p). Nothing wrong with ANTO but not a stock I can get too passionate about. RIO was bought in late 2015 as a relatively safe sector play with the key attraction being a strong balance sheet – that now seems less of a reason to hold. The Contrarian Portfolio could probably do with at least one large diversified miner, but I’m not convinced Rio is my first choice given its commodity mix (too much iron ore) and ultra-conservative strategy.

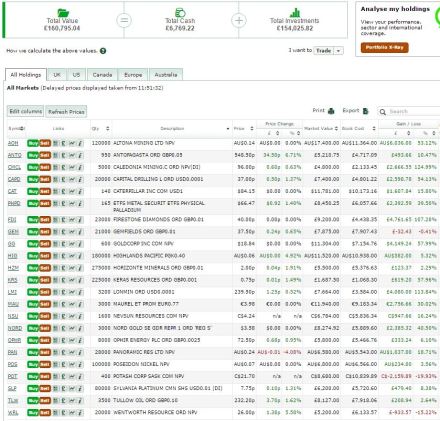

The value of Contrarian stands at £160,795 today with £6,769 now in cash. The portfolio is up almost 61% since I started in November, compared to the FTSE 350 Mining (total return) index up 35% over the same period.