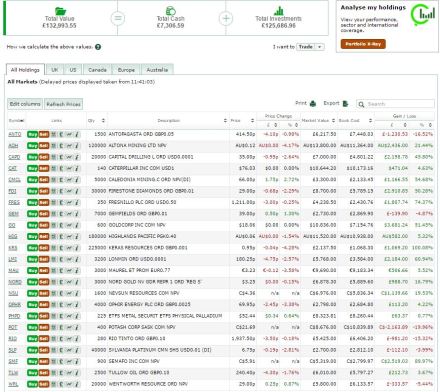

The value of Contrarian Miner is currently £135,623 – up 2% since I posted a fortnight ago, which is more than I can say for the performance of my ISA over the same period.

Significant positive contributors have been:

- Fresnillo +23%

- Keras Resources +16%

- Caledonia Mining +14%

- Semafo +10%

Currency has also been a major tailwind as around a third of the portfolio is priced in USD/CAD/AUD. But offsetting the gains have been horrid performances from Highland Pacific (-17%), Maurel Et Prom (-17%), Nevsun (-17%) and Wentworth (-16%) largely on company specifics (lack of demand hampering ramp up for Maurel/Wentworth and an acquisition that shareholders don’t like for Nevsun).

I have today sold 175 Fresnillo at £15.06. The stock is up 21% since Thursday and 117% since I bought it in November so taking profits. Feels to me like both RRS and FRES are overbought simply because UK fund managers don’t know where else to hide from Brexit.

Forgot to mention last week that I bought a further 4,000 Ophir at 68p- with rationale unchanged since I first bought this stock on 5 May.

Portfolio summary below. Portfolio is now held 18% in gold, 15% in other precious metals, 8% in diamonds and gemstones, 22% in base metals, 17% in oils, 16% in other commodities and support services and 5% in cash. Looks quite base metals heavy – but I think that is right as the base metals have yet to really recover ground whereas precious metals have seen a significant bounce from their lows.