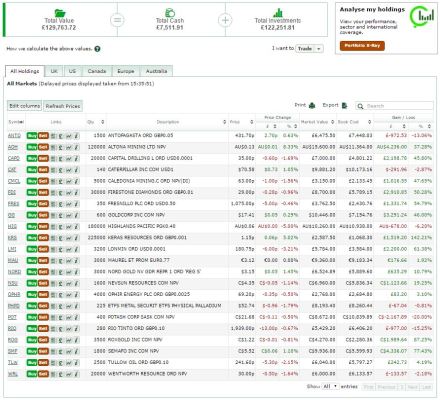

Since I last posted on 12 May, Contrarian Miner is down 2% to £129,763. In current volatile sector conditions I am happy enough with that, however I have made a few tweaks to the portfolio in the last few days:

- Sold my holding in OILB (a Brent Oil Tracker) – 250 shares at $23.42 – a 45% profit. This is not to say that I think we’ve seen the end of the oil price rally. I bought this oil tracker as a “placeholder” to ensure I had some exposure to oil price recovery before I had a chance to hunt down the particular oil stocks I wanted. I have since invested in Tullow, Wentworth, Ophir and Maurel et Prom which together make up 17% of Contrarian. That is enough oil for a mining portfolio, so I am saying goodbye to OILB.

- Sold 4,000 Roxgold (Toronto: ROG) at C$1.22 realising an 87% profit. When I last sold down my holding in ROG on 19 April, I explained my rationale – which hasn’t changed other than the move up in price from C$1.13 then to C$1.22 now (via C$1.40 – pity I missed it). I retain 3,500 shares, but don’t see it as a long term holding.

- Bought a further 90,000 Highland Pacific. Increasing my holding in what I continue to think is an interesting play. Sure both Ramu and Frieda River need higher prices to work (nickel and copper respectively) but both are world class in terms of scale and in addition you get exploration potential thrown in. All for an EV of A$38m . Bargain.

I have £7,512 in cash and lots of ideas for it.

Nothing wrong with fiddling.

John

JohnsInvestmentChronicle.com

Sent from my IPhone

>

LikeLike

Liked your idea on SLPL but still waiting to see JIC jump in first?

LikeLike