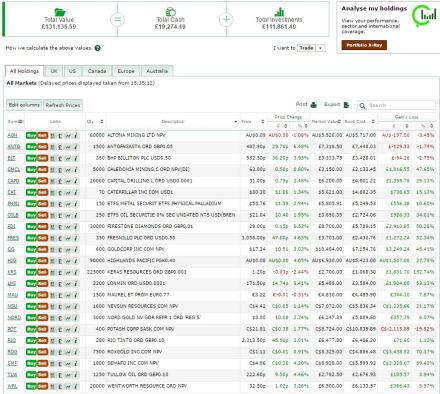

So much for the buying opportunities I was looking forward to. Contrarian Miner is up another 2% today to £131,135.

I have just sold half of my shares in Roxgold (ROG:V) being 7500 shares at C$1.13/share, banking a 75% profit on them.

At the current gold price the company would generate around US$50m in cash each year, which makes for a seemingly generous FCF yield of 13% based on the current EV of just over US$380m.

However, the reserve life of the mine is c8yrs, so at the current gold price the mine would generate cUS$400m in undiscounted free cash flow over the life of mine compared to an EV of US$380m.

Sure the gold price could rise or additional resources could be converted to reserves. But given that its a pre-production asset in Burkina Faso, I’d say its pretty fairly priced right now and am taking some profit. Haven’t decided what to do with the other half – I have a nasty habit of selling things too early so I am tempted to hang on for a bit and see what happens.

I now have £19,030 in cash or 15% of the Contrarian Portfolio. It should be starting to burn a hole in my pocket no matter how overbought the market may be or I’m going to suffer from nasty cash drag. But the contrarian in me wants to sell and not buy on a day like today.

Portfolio below….