Still waiting for that buying opportunity.

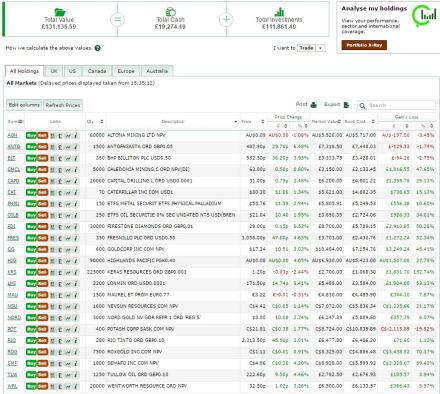

Contrarian Miner now stands at £132,993. Over the past week the Contrarian portfolio is up 4%, lagging the FTSE 350 Mining Index which is up 7%. So I suppose its “could do better” for me this week, but it doesn’t feel like it.

With BHP Billiton up a further 2.7% this morning despite a mixed set of quarterly production numbers, I sold the remainder of my holding (350 shares at 987p). I may well want to own these again in future, but for now I feel its the one stock that has really travelled too far too fast and there are better opportunities elsewhere.

With the proceeds (more or less) I have bought a further 60,000 shares in Altona Mining at 9.4c a share.The shares haven’t really moved at all since I bought the first tranche a month back, so I am happy this is a fine time to buy more even within a sector that is feeling generally overbought.

That still leaves me with cash of £19,607 – too high but every time I find something to buy I seem to find something else to sell.

Portfolio performance relative to index below.