In the past week the Contrarian Miner portfolio is up 8% to £117,186, slightly lagging the FTSE 350 Mining index which is up 11% on the week. Key drivers of portfolio performance this week have been Lonmin (+85%), micro-cap Keras Resources (+31%), BHP Billiton (+17%) and ETFS palladium ETF (PHPD) up 14%.

As previously flagged, I have continued to reduce the gold exposure of the portfolio, selling 900 Semafo last week at C$4.95/share (a 59% profit) but keeping 1,800. I also sold 2,000 Lonmin on Friday at 154p – a 38% profit – the shares powered upward last week on an improvement in the platinum price coupled with confirmation from the company that restructuring efforts are on track, and it seemed to me a sensible time to take some more money off the table .The shares look heavily overbought, and whilst they may still have considerable long term value they are unlikely to continue to travel in a straight line. I still have 3,200 shares in Lonmin which seems ample.

As promised, I have put some of the cash in the portfolio to use, adding three new holdings:

- Caterpillar Inc – 70 shares at $69.50/share. It may be a while before the more upbeat sentiment in the mining and oil sectors translates to new orders, but I think the >70% peak to trough fall in mining sector orders for Caterpillar provides an idea of the long term upside. The balance sheet does not look overstretched even in current depressed market conditions.

- Maurel et Prom (Paris: MAUP) – bought 1500 at EUR2.98/share. Considered buying Nigerian oil and gas co Seplat and then decided MAUP was a better entry point. The company has a diversified set of cash flow generative African oil and gas assets – Gabonese oil, Tanzanian gas (they are the operator for the Mnazi Bay development in which Wentworth has a share) and Nigerian oil and gas (through share in Seplat). The balance sheet looks in reasonable shape and there is also a significant exploration portfolio (albeit on the backburner).

- Tullow. Have been watching Tullow for a while now and finally decided to press the button. Sure, I could have got them 50% cheaper in January, but the balance sheet issues look a lot more manageable at US$39/bbl oil than they did at US$29/bbl (chart below is helpful here). Net debt totals $4.0bn with US$1.9bn cash and debt headroom. Cash flow should turn positive from Q4 16 once the TEN project in Ghana comes on line (Jul/Aug this year).

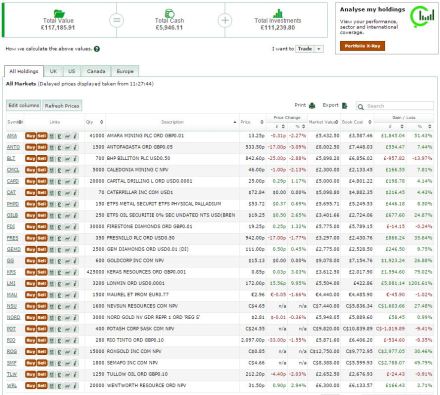

Latest portfolio snapshot is below. I have £5.9k in cash which remains a little on the high side but not burning a hole in my pocket.