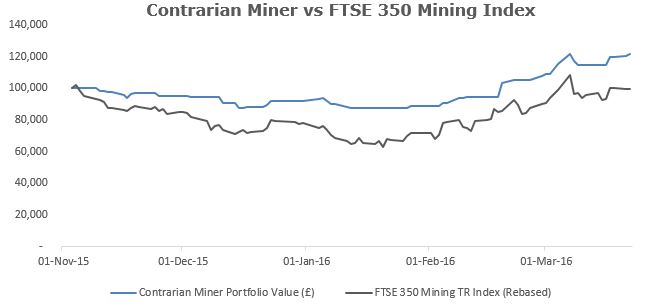

I last posted on Contrarian Miner on 7th March, so firstly an overdue update on portfolio performance. Contrarian is up 4% since 7th March to £121,719 against the FTSE 350 Mining TR index which is down 10% over the same period. Since inception Contrarian Miner is up 21% against the mining index which is flat.

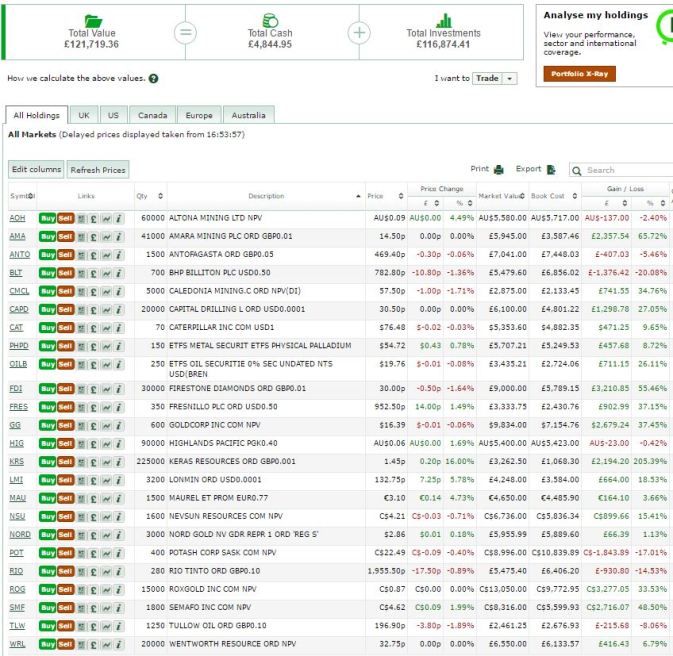

Last week I made a few changes to the portfolio, introducing some fresh ideas. I have added two Australian copper juniors:

- Altona Mining (ASX: AOH, Mkt Cap A$50m) – bought 60,000 shares at A$0.06. In my opinion Altona Mining’s Little Eva project looks very doable (cash costs around $3,600/t but low capital intensity). And they already have (subject to deal completion) a Chinese partner to fund the majority of the capex with the remainder sitting in cash in their bank. Clearly the deal could fall through, however at an EV of A$6m (market cap of A$50m and cash of A$44m) that’s a risk I’m willing to take particularly as their significant cash balance gives them space to weather the storm if needs be.

- Highland Pacific (ASX: HIG, Mkt Cap A$56m) – bought 90,ooo shares at A$0.06. Highland Pacific has an interesting portfolio of significant projects in Papua New Guinea in which it is the minority partner. It owns 20% of the massive Frieda River copper project in PNG (previously an Xstrata project but now been pursued as a slightly small scale project by Panaust/Guandong Rising). It also has a share in the completed $2.1bn Ramu Nickel operation – this will need a higher nickel price to work but they were free carried through construction and in effect its a free option on the nickel price. Lastly they have recently JV’d with Anglo American on their Star Mountain copper-gold exploration project. It may take time, but it seems to me all of these are world class projects and that is definitely not reflected in the current A$56m market cap.

I have partly funded these new purchases through the sale of half of my holding in Keras Resources (200,000 shares at 1.08p). I bought this micro-cap stock at 0.47p per share because I like the management and the African assets. Over the past 3 months it has morphed into a small-scale Australian gold producer and without having had a really close look I am not entirely convinced I am excited about the change. In any event with the stock up over 100% I sold half – sod’s law it is up a further 40% since. I have also sold the remainder of my Gem Diamonds (2,250 shares at 109p) but retain diamond exposure through FDI.

Portfolio below.