I think I said on Monday I was fighting the urge to sell too early on CEY.

Today with the shares up a further 2% since Monday, I have given up the fight and sold half (4,000 shares at 76p each realising a profit of 24% on them).

Nothing wrong with the company, indeed if anything it is looking more solid than ever.

But I am feeling a bit more confident in the prospects for the resources sector and think Contrarian Miner needs a bit more spice (and a bit less gold). So am replacing CEY with stocks I think have further to run.

The new stocks I am adding to the portfolio are:

- Wentworth Resources (London: WRLW) – A small cap oil and gas play in East Africa. The gas is now in production with the price fixed by long term contract. Volumes will ramp up in due course with upside potential as and when demand grows. After tax NPV on their share in this is $153m (their figure) against an EV of <$110m so not only are you buying into this solid asset at a discount but you get the rest of the exploration portfolio free. I have bought an initial 10,000 shares at 29.8p and may add more;

- Firestone Diamonds (London: FDI). Three diamond stocks is no doubt too many, but I have been wanting to buy FDI for a while so am taking the opportunity. Recent updates from the company on mine development are reassuring – project looks on track and management appear confident. Funding through to first production is a little tighter than I would like it to be ($9.8m in headroom excl. the standy facility or U$25m with it) but currency remains a slight tailwind on this and there may be opportunities to bring forward first production a smidgeon. I have bought 15,000 at 17.75p.

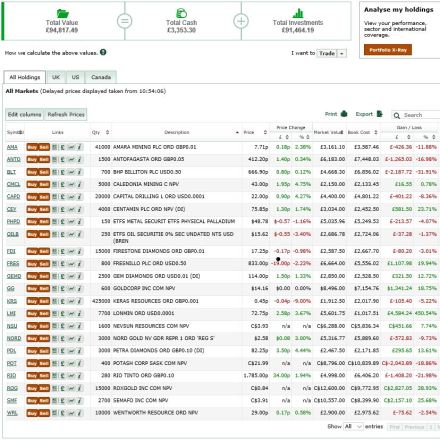

The Contrarian Miner portfolio stands at £94,817 (up just under 1% in the past 2 days against the FTSE 350 mining index down 5%).

Great performance considering the markets. Already have diamonds covered with GEMD. Wentworth looks interesting though.

LikeLike