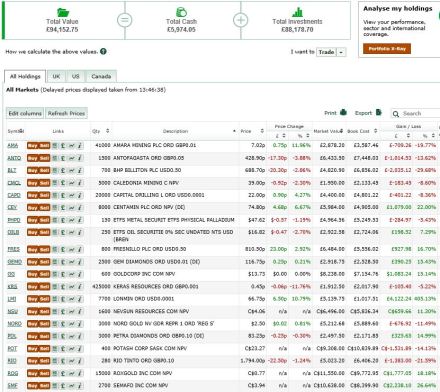

Contrarian Miner portfolio is up 4% since 4th Feb to £94,153 – its highest level since 10th December – with precious metals stocks leading the charge (Lonmin +26%, Goldcorp +10%, Roxgold +8%, Centamin +7%, Nevsun +7% and Semafo +6% since 4th Feb).

Catching my eye is the significant outperformance of Centamin. I bought this stock primarily because of its defensive characteristics – low cash costs and all in sustaining costs and thus cash generative at spot, with net cash on the balance sheet and dividend paying.

A good operating performance in Q4 means Centamin met full year 2015 production guidance. The company expects to produce more gold in 2016 at lower cash costs and AISC. That coupled with a 10% increase in the gold price since I bought the shares has resulted in a 22% rise in the share price. It feels as though the company has put the tough year it had in 2014 behind it, and investor confidence has recovered significantly.

That makes the Contrarian in me feel like heading for the door, but with no particular reason to do so I am fighting the urge. That said, I am looking for 100% upside for Contrarian Miner in 2 years and I am not convinced Centamin offers that so this is not a fundamental long term holding for me.