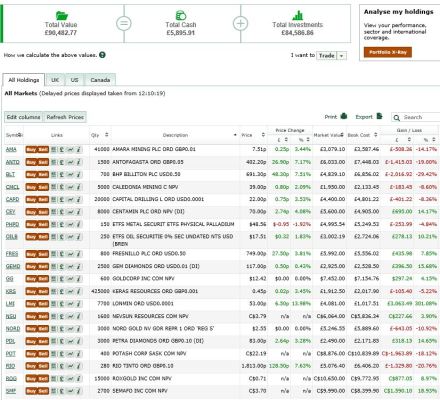

A long overdue update on Contrarian Miner, which is down 3% in the past month to £90,483 against the mining index which is unchanged on its 4th February levels, somewhat closing the previous gap between the portfolio and the index as shown in the chart below.

What strikes me more, is the extent to which today’s figure mask the meltdown of the last month. The FTSE 350 mining index has bounced back 20% from its 20th January low. And while Contrarian Miner’s greater exposure to gold and other more defensive plays has meant it has been less volatile, individual stocks have seen significant movements – Petra Diamonds ends down just 1% to 83p but visited 69p on the way following its IMS.

Earlier this month, I thought it a good idea to add some oil to the portfolio, and in the absence of enough time to do my homework properly on oil stocks, I bought 250 shares (£2,724) in OILB.L as a shortcut (its an ETFS Brent Oil ETF). Its up 10% since I bought it.

I have £5,896 in cash in the portfolio, and plenty of ideas of what to do with it. But today does not feel like a buying day so I will sit on my hands a little longer.

For those of you about to descend on Cape Town for the annual Indaba circus, I can report it is sweltering here. Bring shorts.