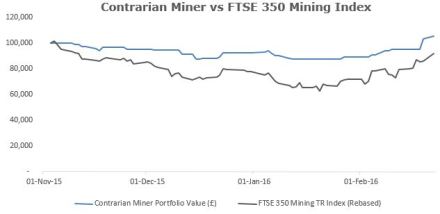

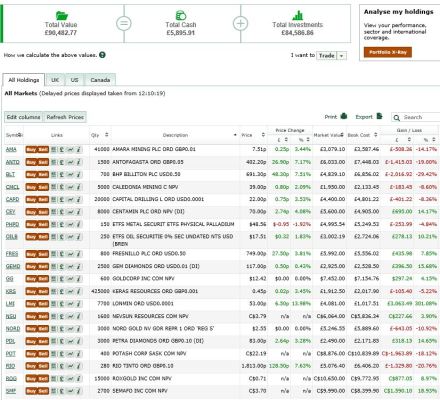

Contrarian Miner is up 3% in the past week to £108,059 against the FTSE 350 Mining Index down 3% over the same period.

The key driver of the week’s performance is the 26% rise in Amara Mining following firstly positive results from the optimised pre-feasibility and then today a recommended (shares + warrants) offer from Perseus mining.

Amara shares are up 18% today to 11.75p but nevertheless remain 10% below the share portion of the Perseus offer (which is 0.68 Perseus shares or 13p at today’s Perseus share price) even before taking into account the value of the warrants (theoretically another 1.68p per share). I’ll need to take a closer look at Perseus before making up my mind what to do should the offer proceed, but given the significant gap between the offer on the table and the share price it seems to me sensible to hold for now in any event. The optimised PFS reflects a post tax NPV10 of US$473m for the Yaoure project at US$1,200 gold, which provides me with ample comfort there is value in the stock even should the deal fall through for any reason.

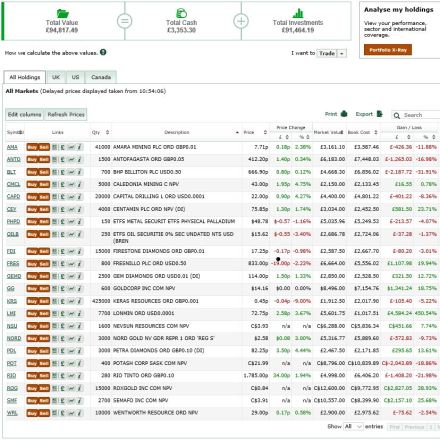

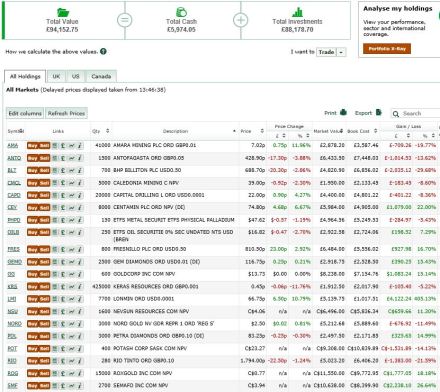

Have done a bit of portfolio reshuffling:

- I have sold the remainder of my Petra Diamonds shares (3000 at 92p) on Friday. The half year results were awful and on top of that the company is flagging it will most likely need banks to waive the June covenant test as well. I suspect a recapitalisation may be needed, and I am unconvinced that’s what the current share price reflects;

- I have bought a further 10,000 Wentworth at 31.5p as well as a further 15,000 Firestone at 20.8p. Have been waiting for an opportunity to buy these stocks cheaper on an off day for the sector, but finally decided the opportunity cost of sitting with more than 10% of the portfolio in cash is higher than the extra penny or two on the share prices of these stocks.