After weeks of vacillation, I finally decided today to take advantage of the 9% (dead cat) bounce in Anglo since last Thursday to exit my position. And so today I sold my 900 shares at 288p per share, crystalizing a 45% loss.

What changed my mind about Anglo? Since I bought it on 6th November, copper and thermal coal prices are down a further 6%, platinum 7% and iron ore 17%. By my calculations, that wipes a further US$1.1bn off Anglo’s 2016 revenue. And I am not convinced the balance sheet, which was already stretched, can withstand that additional pressure without an equity injection.

That is not really a contrarian view, however when the analyst community is increasingly in agreement the company needs equity – and at spot prices that view does not seem wrong – the risk is the share price continues to slide until an equity deal is announced. Pressure from the markets can become self fulfilling.

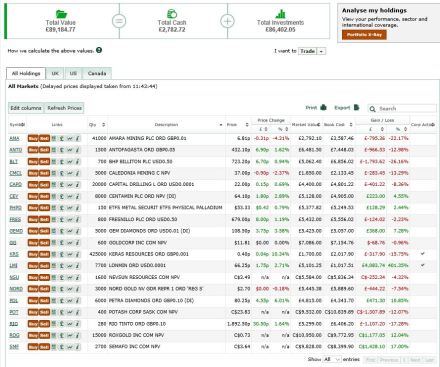

Following today’s trade, the portfolio stands at £89,185 – up 2% from last week’s low.