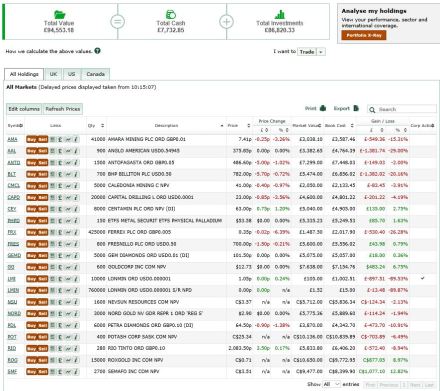

The Contrarian Miner portfolio currently stands at £94,553 – little changed in the last 10 days as further 8% losses in Anglo American, BHP Billiton and Rio Tinto were offset by a 13% increase in Semafo and an 11% recovery in Petra Diamonds following the announcement from the latter that banks have agreed to waive the Dec 15 EBITDA covenant tests. It is reassuring to see some individual stocks in my portfolio outperforming the sector but without a meaningful improvement in commodity prices, contrarian miner can’t really hope to see meaningful gains overall.

In a fit of madness late last week I bought a further 300,000 Lonmin rights. Whilst that set me back just £15 it means I now need to cough up £7,600 to follow all of my rights. I still have the rest of today to change my mind, but following the significant bounce in the platinum price late last week, the fundamentals for Lonmin are looking far better than they were and that is not to my mind being reflected in the share price so I am inclined to go with this. No-one particularly wants to put cash into Lonmin (and the banks that underwrote the rights issue are no doubt feeling a bit tender), but in my opinion once the cash is in the bag the market can start to think about the long term value of this company again.