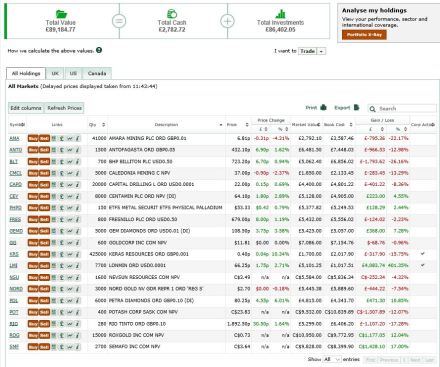

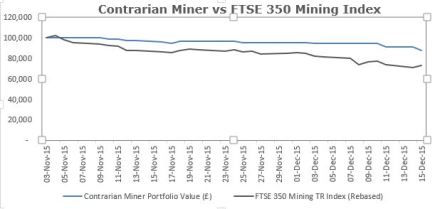

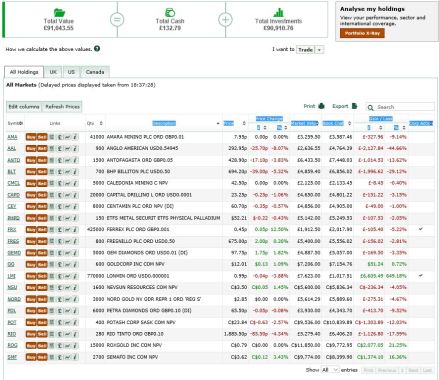

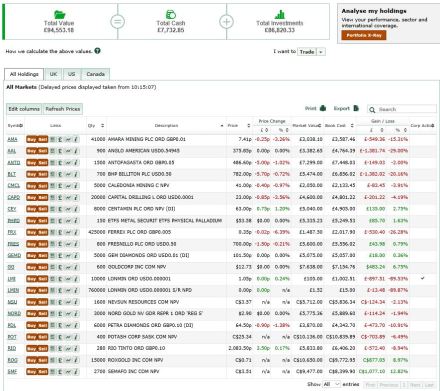

I’m not entirely sure the statement out of China that “the government will make fiscal policy more forceful and monetary policy more flexible to keep growth in a proper range in 2016” has me entirely convinced it is the end of the end for the mining sector. Clearly the market feels otherwise, however, and the Contrarian Miner portfolio is up more than 3% today to £92,238 (lets not talk about the Anglo shares I sold yesterday shall we).

Although Petra remains arguably good value at current levels, its balance sheet concerns have not vanished – banks waiving the December covenants has simply bought them six months. The shares are up 60% in the last month, and that feels to me a bit too far too fast. So I sold half of my holding today (3,000 shares at 88p per share) realising a 22% profit. This is more of a trading call than a fundamental call (and I would be tempted to buy them back if they were to revisit 70p).