Using the opportunity presented by todays market weakness, I have invested a further £19.8k and am now 30% invested.

In part, I have topped up existing holdings, buying:

- 300 Anglo American at 491p

- 300 BHP Billiton at 950p

- 9500 Capital Drilling at 23.9p

- 3000 Petra Diamonds at 65.2p

I have also added four new holdings:

- Nord Gold (GDRs) – bought 1500 at US$2.90. The billion dollar London listed gold company no-one’s ever heard of. Partially because its only 10% free float and it’s Russian owned with assets in Russia and West Africa. But with annual production of just under a million ounces, all in sustaining costs of less than US$800/oz and a dividend yield of c5% I think it very attractive. The company is looking to move to a premium list next year which could attract a wider audience – in the interim given the size of the Contrarian Miner portfolio, the low liquidity isn’t really a big issue for me.

- Goldcorp – bought 300 at US$11.71. This is not a stock I have looked at closely in the past but I was looking for a gold company with a relatively strong balance sheet and low cash costs and this appears to fit the bill (all in sustaining costs US$848/oz). Arguably Randgold does too with a great management team as well but I am not entirely convinced the value equation on that stock stacks up at current levels given the high risk geographies it operates in.

- Lonmin – 10,000 at 9.9p. Only yesterday asked if I thought Lonmin was worth looking at at current levels I said I wasn’t sure it was time yet – the company may have secured the $400m they need through yesterday’s 46 for 1 rights issue (at 1p) but at current PGM prices it is still cash flow negative even after everything they have done to cut costs. But below 10p today I couldn’t resist. I have bought 10,000 which may not seem a lot (under £1000) but bearing in mind I need to allow for another £4600 to follow my rights.

- Antofagasta – 1000 at 497p. We can debate the direction of the copper price, but with a strong balance sheet, good margins and cash generation, Antofagasta should be well positioned to weather the storm and provides a welcome counter-point for some of the balance sheet risks I am carrying in the rest of the portfolio.

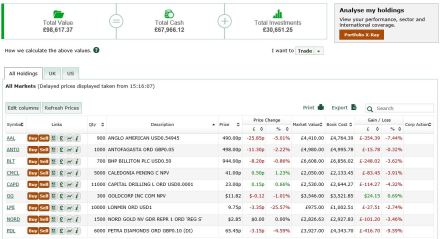

Here is a snapshot of my portfolio today following these trades.