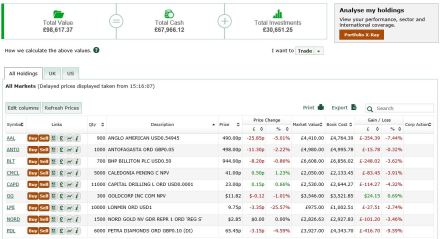

To take the portfolio to over 90% invested, I bought three new Canadian stocks – again seeking decent margins and strong balance sheets whilst also looking to broaden the commodity exposure of the portfolio:

- Roxgold (15,000 shares at average price of C$0.65). Another gold stock, but exceptional grades mean that all in sustaining costs are expected to be US$590/oz. Fully funded to first production next year

- PotashCorp (400 shares at C$27.07). Not only do I like potash as a commodity, but I also like PotashCorp’s strong market position, good margins and generous (arguably too generous?) 7% yield.

- Nevsun (1600 shares at C$3.64). Copper and zinc in Eritrea. Nevsun has lowest quartile cash costs of copper production and I like the long term growth into zinc where long term fundamentals look very sound. The company also has US$434m in cash which positions them well to capitalise on organic or other growth opportunities.

I have also added to holdings in Goldcorp (buying 300 at US$12.08) and Semafo (buying 1500 at C$3.12).

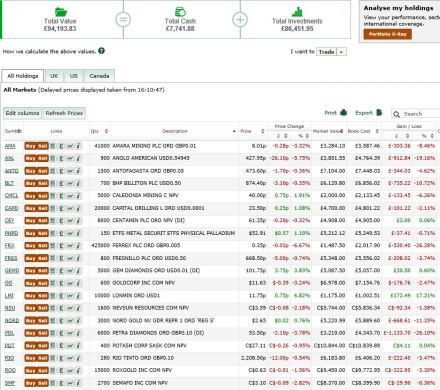

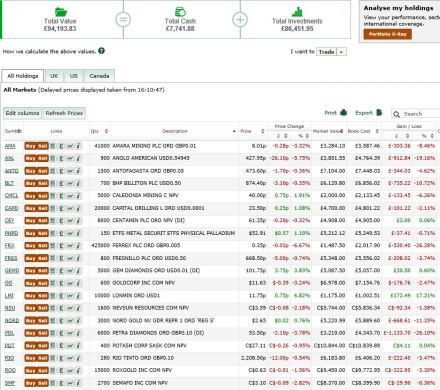

I now have £7,742 in cash remaining of which £4,600 is earmarked to follow my Lonmin rights so I will pause for breathe there.

Already I am living to regret some of my choices (at the very least the timing) with Petra Diamonds down 26% and Anglo American down 19%. The only stock in decent positive territory to date is Lonmin which is up 17% but I may have just caught a lucky print on the screen as it is swinging around wildly. The portfolio overall is down 6% to £94,193 which after only 10 days does not appear a particularly auspicious start but I remain sanguine.

Below is a snip of my portfolio, which now comprises 20 stocks including 7 gold stocks (Amara, Caledonia, Centamin, Goldcorp, Nord Gold, Roxgold and Semafo). 11 out of 20 of the stocks in the portfolio operate primarily in Africa and only 5 are not London listed – the familiarity bias in action.